Digital Services Design for Equipment Manufacturing Companies

Digital Services Design for Equipment Manufacturing Companies

In this article Aart Schalk, Senior Management Consultant at Linde Consult and Noventum, shares how you can start designing digital services and how to manage the service transformation.

Equipment manufacturing companies increasingly innovate their (service) product portfolio by creating solutions that combine product and service components. However, shifting from a product-centric perspective to a service-centric perspective is challenging for a number of reasons. In this article I explain how to successfully transform into a service-centric organisation by using the Product Service System (PSS) approach in combination with Service Dominant (SD) logic to design and deliver the right digital services for your customers. In simpler terms: combining product related and customer business related service design.

From product-related to customer business related service design

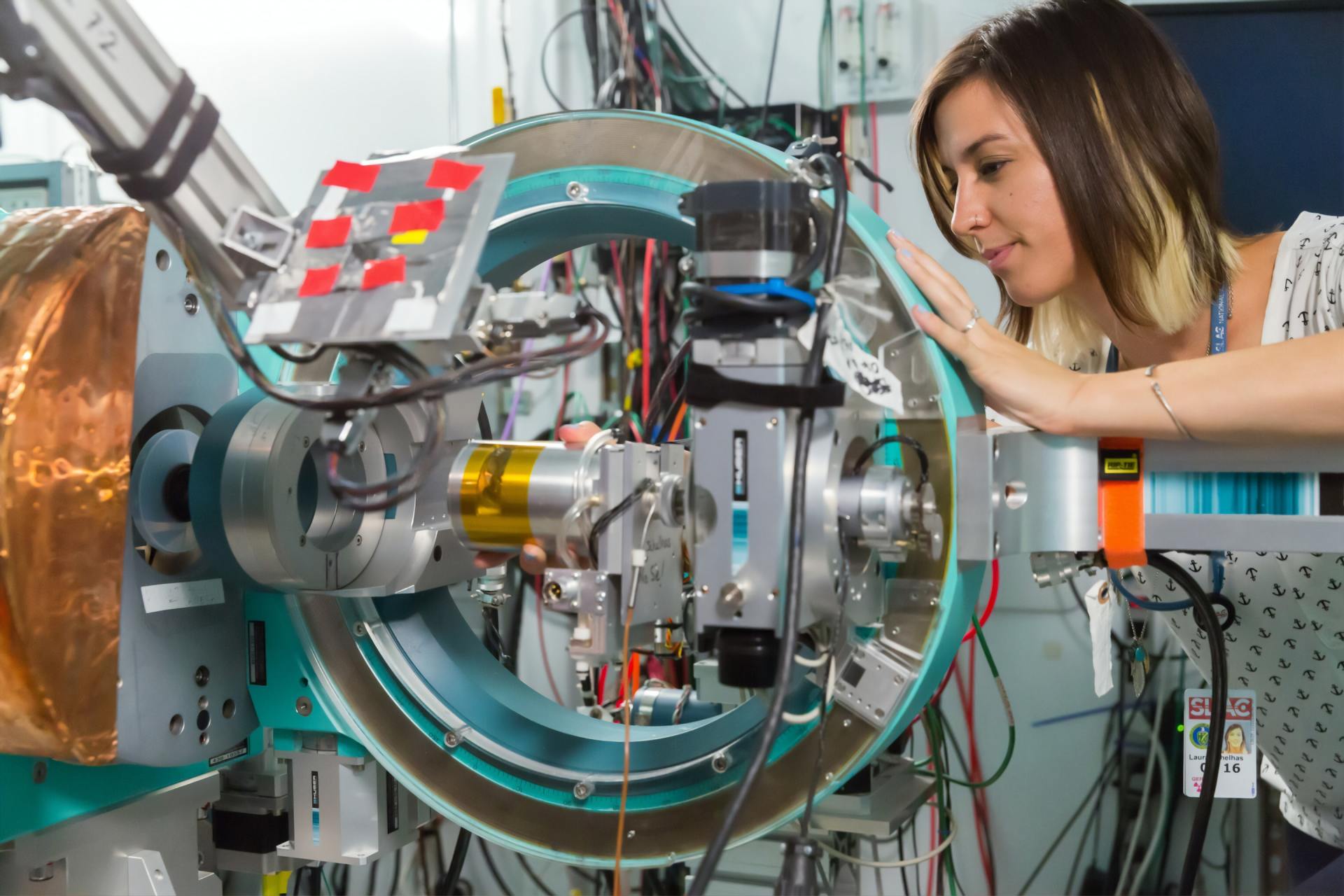

Typically, equipment manufacturing companies apply product related service design and do not pre-produce value but strictly offer value propositions that customers convert into value through usage. Think of product related services such as (extended) warranty, preventive maintenance schedules, and availability services through service level agreements.

Here, customers are always co-creators of value by integrating the company’s offerings with their collection of resources, including personal skills and capabilities. Example: A food processing customer has an issue with a cutting machine and orders a spare part via an online portal. The part arrives the next day in the hands of the maintenance crew who replaces it as described in the manual and restarts the machine. Problem solved, right?

This product-oriented perspective has influenced how services are designed and led to a) the development of product related service offerings that facilitate customer value co-creation processes and b) to focus on service levels and outcomes for customers. While good reactive service and quick delivery of parts is appreciated by customers, the manufacturing industry has the opportunity to offer more advanced services that generate higher customer satisfaction, loyalty, and more margin at the same time. Let’s see how!

Bundling product related service solutions: Servitization

To address globalization and rapid technological development, manufacturing companies now start to use the customer business related service design approach in combination with product related service design in an attempt to integrate services in their product offerings to create more complete solutions. This transition is referred to as ´Servitization´. It consists of shifting the business from selling products to offering product-service system solutions.

Product related service solutions are bundles of product and service components intended to co-create value-in-use for customers and are usually supported by organisational networks and systems. Good examples here are Rolls-Royce (power by the hour) and Xerox (managed print service).

This perspective has influenced how services are designed as well and has led to a) customer business related services and b) addressing latent customer business needs through proactive service delivery. These more automated and advanced services typically include customer process and business optimisation via outcome-based services, business transformation and even value chain optimisation. To become a successful proactive service organisation enabled by digital services takes time and effort. Let’s take a look at how you can achieve your goals.

How-to-guide: Service transformation journey

So, where do we start? Noventum Service Management defined a three-phased transformation journey grounded in research; tried and tested for over 20 years in various industries and all around the world.

1. Setting the climate for Servitization

- Identify customer service needs

- Calculate growth potential

- Design customer experience per segment

- Assess internal operations

- Calculate the profitability potential

2. Deal with organisational resistance

- Set up regular steerco’s with senior management

- Design transformation and engagement strategy

- Inform organisation with senior management

- Execute transformation and engagement strategy

3. Develop internal skills and capabilities

- Design and pilot the value proposition and service business models

- Design service delivery model

- Define IT infrastructure

- Redesign organisation with senior management

- Fill in the new organisational design and train people on new role

- Implement net organisation

- Scale up services

To conclude: Service transition is a journey, not a destination. So approach it accordingly. Celebrate your successes along the way; and use failures as learnings so you can do better next time.

Note1: This article was first published on the Noventum LinkedIn pages and website in October 2020.

Note2: In case if you want to learn more about how to develop new digital value driven business models, Noventum just launched the Leadership in Digital Service Transformation, an online training about how to lead a service transformation.