JBT Marel Acquisition - Analysis & Impact

What will be the impact of the JBT purchase of Marel?

In recent months, we have thoroughly examined the intricacies of this strategic merger, expected to transform the global food technology landscape—establishing a formidable leader in food tech innovation.

We spoke with a number of stakeholders including investors, industry watchers, JBT and Marel people and customers about the acquisition’s potential impact, to answer 20+ critical questions.

What did we find?

While you need to purchase the full report to get all answers, we can share the following in this article:

Market share of the combined company

JBT Marel is strategically positioned to emerge as a leading player in the Poultry Industry, currently holding an impressive combined market share of 20%. In addition, the company has established itself firmly in the Seafood Industry, boasting a noteworthy combined market share of 10%.

Beyond these primary markets, JBT Marel also claims a combined market share of 6% in the growing field of plant-based products, along with 8.2% in the pet food segment.

Moreover, JBT Marel benefits from a significant presence in related sectors such as pharmaceuticals and nutraceuticals, which presents exciting opportunities for expansion and innovation.

It is worth noting that many food supplements and pharmaceutical pills are produced using equipment that is similar to what is employed in food processing, particularly during the secondary and subsequent processing stages.

This overlap not only underscores the versatility of JBT Marel's technology and expertise, but also highlights the potential for cross-industry synergies that could further enhance the company's market position and growth prospects.

Share price of JBT after Marel integration

From October 2024 to December 2025, we anticipate a 12% rise in JBT FoodTech shares, followed by a 12.5% increase in 2026. The projected price per share is expected to reach 125.15 USD by year-end 2026.

Business area's in which JBT Marel would offer a winning solution

The merged company is poised to deliver a robust portfolio of comprehensive Poultry Processing solutions, encompassing equipment for every stage of the process—from live bird handling, killing, and evisceration, to cut-up and deboning, followed by weighing, grading, sorting, batching, as well as packing, boxing, and labeling.

In the realm of Further Processing Solutions (cooking, baking, cooling, freezing, coating, frying, etc.), the combined entity is expected to be able to compete well with players such as Provisur, Middleby, Handtmann, and Vemag.

We believe that exploring the niche market of ‘Rendering’ poultry and seafood offal presents a valuable opportunity for the newly formed company.

In the Petfood segment, numerous innovations from Marel—ranging from deboning and meat scrap collection to grinding, forming, baking, X-ray vision technology, metal detection, and AI-driven software—could significantly enhance the offering.

The conclusion?

The JBT FoodTech-Marel acquisition stands on solid ground, with a high likelihood of success due to the remarkable alignment of the two companies. Their shared culture, vision, and corporate DNA create a natural synergy, while the compatibility of their product and sales portfolios paves the way for seamless integration.

Moreover, we believe this merger presents significant opportunities not only for growth through an expanded global presence and enhanced innovation capabilities but also for operational cost efficiencies. By combining resources and streamlining processes, the newly merged entity will be well-positioned to unlock long-term value and drive the future of food technology.

Get your full report now!

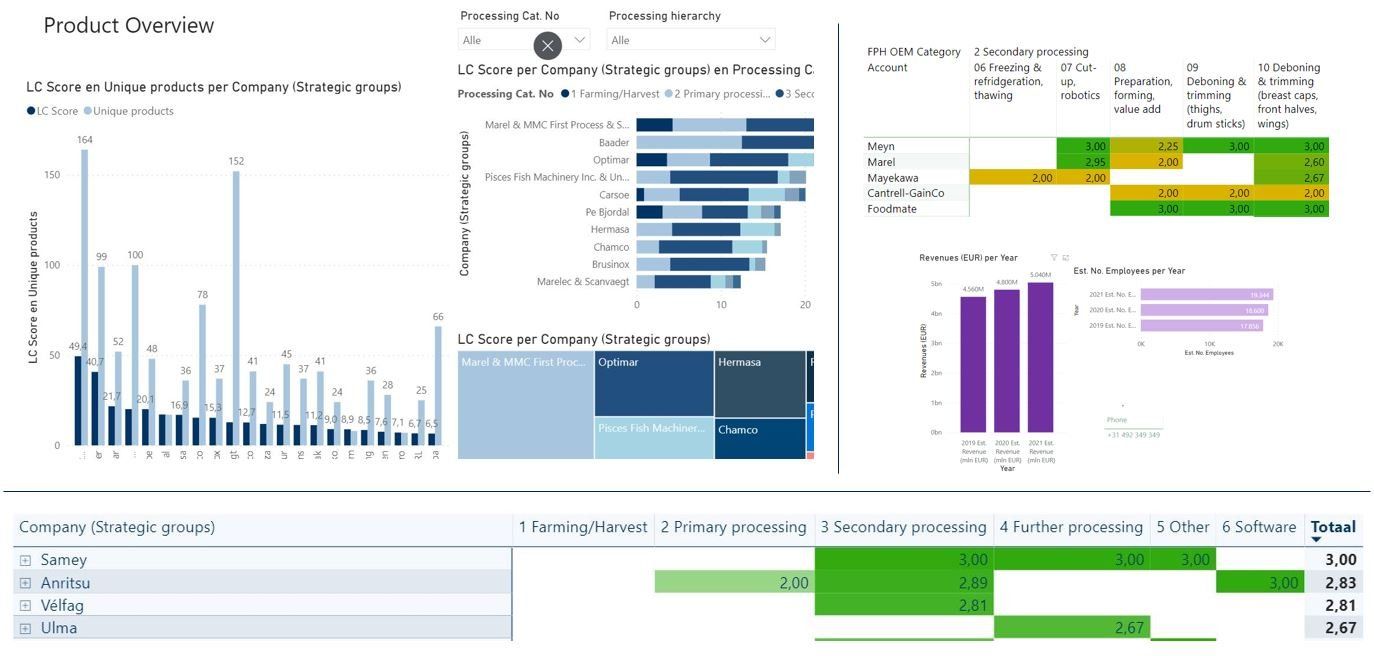

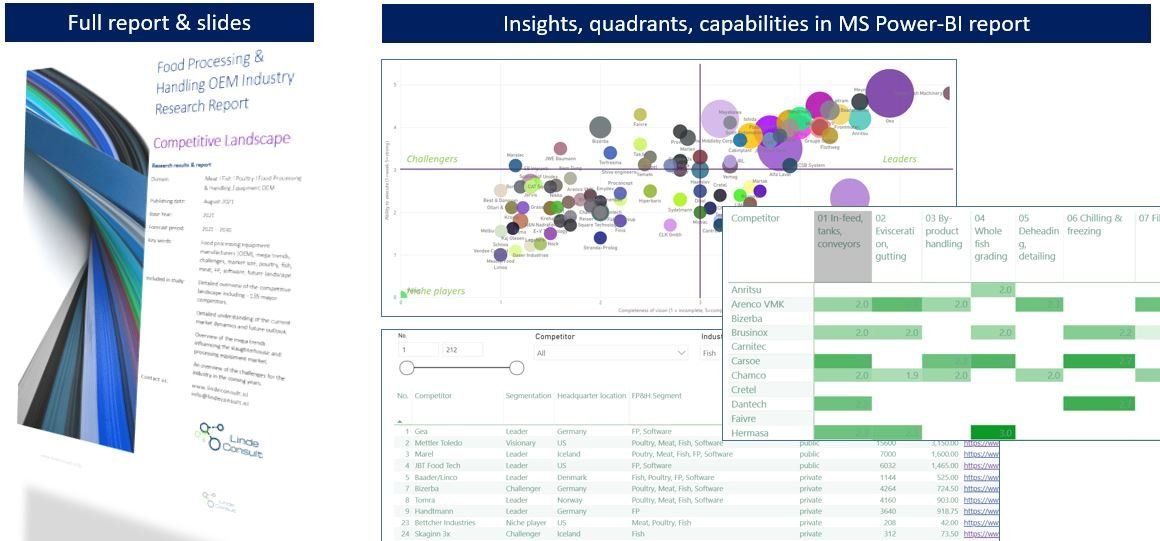

Packed with detailed analysis, data-rich tables, compelling figures, and vivid illustrations, this report is an invaluable resource for investors, decision-makers and industry leaders in Food Processing.

Don't miss out—order your copy today and stay ahead of the curve!